176 days to go: pivoting investor outreach and winding down for Christmas

A recap of week nine as a full-time founder

Hey there 👋🏾,

For those of you who are short on time, here are the sections of the newsletter you may want to skip ahead to…

Win🏅: Pivoting my investor outreach strategy

Loss 🤕: Feeling uncertain how to follow up with slow/no-responding investors

Lessons 💡: Why you’re responsible for creating your own sense of peace

As always, I appreciate feedback, so feel free to leave comments or reply to this email with your thoughts.

🎯 Objective

Decide on next steps for investor outreach (especially with Christmas around the corner)

Christmas is just 3x weeks away 😱

With that in mind, I spent last week thinking about how to wind down my outreach in December how to prepare to go again in January.

On the upside, I bounced back from feeling very low/burned out and had a week crammed full of really helpful conversations, great events and strategic progress.

But the most important thing was reflecting on what has been achieved so far to better understand what my next steps should be.

🔋 Progress recap & highlights

Biggest wins

WIN 1️⃣: Deciding to pivot my investor outreach strategy ✅

In last week’s newsletter, I shared a link to the Female Founder’s Rise global map of Angel syndicates. A massive shout-out to Emmie and her team for putting this together because it is an incredible resource for Founders and I highly recommend that everyone who is raising puts this to good use. There are over 30,000 syndicates listed on the map, so you are bound to find a few that are a great fit.

When I finally sat down and combed through this map, I naturally started with where I’m based (Europe) and the areas we’re expanding to (USA).

These are two of the most over-saturated places in the world when it comes to fundraising, so any Angel or syndicates will be inundated with outreach and applications. And, come January, when everyone’s outreach kicks off again, there will be an abundance of Founders going after the same funds and Angels.

In my mind, I have two options:

Follow the crowd and go for Angel Syndicate’s the two most popular regions of the world

Go for Angels and Syndicates in other regions where people will likely understand the problem I’m trying to solve, and fewer Founders are fighting for their attention.

I’m going for option 2.

This doesn’t mean that I’ll run from the chance to speak to Angels and Syndicates in Europe and the US, it just means that I’ll spend more time focussing elsewhere.

In true time-saving fashion, I’ve already reached out to someone on Fiverr who can get the contact details of Angel investors in the regions I’m targeting (it will cost me roughly $150 to get 1.5k-1.9k email addresses).

I’ve mentioned this in a few of the weekly updates, but can’t emphasise enough that data entry isn’t a good use of time. My advice is; get a list of investors from someone who can do that job quickly and then do some due diligence by looking at LinkedIn profiles, past interviews and anything else you can find online.

As everyone will be wrapping up for Christmas and New Year pretty soon, I’ll wait until January to start reaching out to new contacts. In the meantime, I’ll have a list of people to reach out to and 15 email templates/subject lines that have been tried and tested for 8x weeks, so my outreach should be even stronger in January.

TIPS FOR SYNDICATE APPLICATIONS: Most Angel Syndicates have an application process and a form to complete. There are some questions that will always come up (e.g. problem, progress, team) and you will save yourself a tonne of time by creating templated responses to these questions and tweaking them accordingly for each applitcation. I also recommend creating a spreadsheet to track all of the applications you've made with follow updates, otherwise you'll have no idea what syndicates you've applied for or when.WIN 2️⃣: Automation performance update: 3x calls booked in ✅

Here’s the weekly status update on my email automations and outreach:

📧 1,019 people have opened my emails so far (up 7.7% WoW)

↩️ 78 or so people have replied (up 41% WoW)

🥈 66 people replied after the 2nd email in the series (up 26% WoW)

The emails combined with LinkedIn outreach led to:

2 x investor calls booked in pre-Christmas

1x investor call booked in January

1 x potential partnership

I added 315 people to the best-performing automation last week, to make sure they would get 2x emails pre-Christmas and the rest in January.

Given that over 75% of replies have come from the 2nd email onwards, starting my last automation last week, gives me the best chance of booking calls in early January (vs end of Jan, early Feb).

TIPS FOR IMPROVING AUTOMATIONS: Make sure you're tweaking email copy ad you gather more data and feedback from your audience. I've had 2-3 investors get confused about the region I'm in and expanding into, that gave me reason to tighten the copy to reduce the chances of that happening in the future. Everything you create is an opporutnity to do better in the future, so don't take it personally and just adapt. WIN 3️⃣: 3x Founder calls that helped me with product development, partnerships and investor introductions ✅

Calls with other Founders are just as valuable to me as calls with investors. Why? Because there is so much to be gained from people who have been there, done it and worn the t-shirt.

Last week, I spoke to 3x Founders, all of whom helped me in some way that I didn’t necessarily expect but desperately needed. Here’s a quick recap of my key takeaways:

Product development: I was challenged to consider building my product in a slightly different way. I plan to share this with the tech team that I’m working with to see how this could potentially work. Having ideas from the outside often helps us to try/test new things that could significantly move the needle.

Partnership opportunity: I currently have partnerships with 16x Black-owned hair and beauty brands in the UK. Thanks to a call (which came from cold email outreach), I’m now speaking to an American hair and beauty brand that’s interested in becoming a partner as well.

Investor intros: Two of the three Founders I spoke to offered to introduce me to other people in the space and investors who may be interested in my raise. Bonus, 3x of the warm intros are with people on my A investor list.

As tempting as it can be to just speak to Founders who are in your space (e.g. Beauty, Tech), I’ve gained a lot from Founders in other industries as they’ve been able to give me another perspective on my product and approach.

Just speaking to people from my community may create a sameness in thinking that will slow down Mane Hook-Up’s growth or progression (none of which I want), so going forward I’m going to make more time for conversations with people outside my typical network.

WIN 4️⃣: Attended 2x events and met more Founders and investors ✅

I’ve given myself the challenge of attending an event every week in the build-up to Christmas and last week, I doubled up.

I was lucky enough to get a spot at the EmpowerHER event on Wednesday evening (after making it off the waitlist!) and I went to the Angel Investment School’s Christmas party for Founders and Investors. Here’s what I learned:

EmpowerHER: Unlocking investment for female founders

We kicked off with an hour-long panel discussion with some incredible female founders and investors. All had stories to tell (good and bad) about their experiences of fundraising, and it was great to get a heads-up about some of the pitfalls to avoid.

Here are some of the most interesting things I heard on the night:

US vs European investors’ risk tollerance

US investors have a higher propensity for taking risks. This comes down to 1) with 300 million people in the US there are often bigger opportunities to break into and justify a market 2) there are a lot of ex-start-up operators and ex-founders who invest in the US compared to Europe, where many investors are from the banking industry where risk is perceived very differently.

Locking down your fundraising narrative

Get a full view of why you’re the one, why the solution is compelling and be selective with the investors you target. Use a CRM to tier/segment — remember you’re fundraising with individuals, so find a chance to connect with them on a human level.

Look for investors who can help you in your next funding round and remember they aren’t just a source of capital, they also need to help you build connections.

Cap tables

Think of your cap table as a sports team — make sure you know the roles/positions they play in supporting you (e.g. GTM, law, finances). Not everyone will provide the same value, so think about that very carefully before signing the dotted line.

Advice on locking investors in

Always ask what the fundraising process is — how long it takes, who is the decision maker, and who will follow up. Book the following call while you’re speaking to them to make sure there’s another conversation lined up. Serious investors will commit to another call there and then.

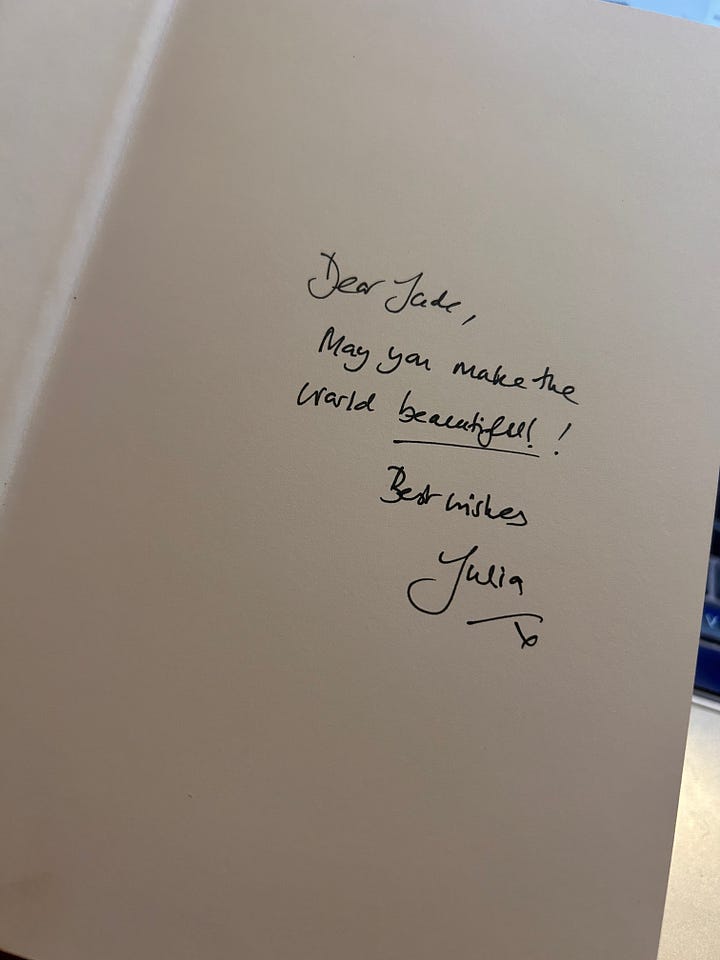

If that wasn’t enough, we then had a group fundraising coaching session with Julia Elliot Brown, to sharpen our elevator pitch. The photos below are of some of the slides from the night — check out the slide with the blue background for an ideal elevator pitch example.

This was probably one of the best events I had been to all autumn/winter because the host and guests shared so many nuggets of gold that I will apply to my funding round.

But the best part of the night was grabbing a signed copy of Julia Brown’s book, Raise: The Female Founders Guide to Securing Investment. Since the beginning of my journey, I have had so many questions about how to go about fundraising in the current market and Julia’s book has addressed a few prickly things (e.g. valuations). Highly highly recommend it to anyone who is raising at the moment.

Angel Investment School Investor x Founder Christmas Social

Finally, I finished up the week on Friday at the AIS Christmas social and had a blast meeting other Founders and investors before the holiday season.

This was a perfect networking opportunity and I met many a lot of Founders building incredible products and investors who were curious about products being created in the space.

The one thing I love about the AIS events is how relaxed an informal they feel. It gives you more of a fighting chance to get to know people better, offer support where you can and build up a genuine tribe within the Founder community.

Is this helpful? Share the 240 Days newsletter with your community.

Biggest L’s 🤕

LOSS 😩: Uncertain how to follow up with slow/no-responding investors

There’s nothing like that awkward moment when you’re not sure if someone is super busy… or just not that into you.

With investor outreach in motion for the past six weeks, I’ve had plenty of first-stage calls and I’m now working on second or closing conversations. But the big issue I’ve faced is getting follow-up calls booked in even after some great conversations.

I’m finding this painful for a couple of reasons:

The last thing I want to do is be a pain and clutter someone’s DMs/emails when they don’t want me there 😅

Not knowing where I stand feels uncomfortable as I would rather have a concrete yes/no to know how to manage that person going forwards

This feeling of not knowing what to do can be worse when the conversation felt really positive, or if they’ve asked me to follow up with more info (e.g. financials, terms).

My mind tends to go to one of two places:

It’s the holiday season, people are away and/or busy ✨: Considering Thanksgiving is just behind us and Christmas is 3x weeks away, it’s fair to say that everyone has a lot going on. Investors are people, with families, lives and other priorities, so I don’t like the idea of writing off a conversation because they’ve been slow to respond. However…

No response is also a response of sorts 🙅🏾♀️: In this day and age where you can choose to ignore an email or a DM, not responding is also a way of just telling someone you’re not that interested.

The big question is, when do you throw in the towel? And when do you keep going?

After speaking to a few people, who work in sales (and must be totally bullet proof to cold call for a living 😭), they said follow up until you get a no. Becuase some people need to see your name 10x times before they have the bandwidth to reply. Anyone who’s annoyed and doesn’t want to speak to you, will follow up with you when it gets to that point.

So I’m taking their advice and will follow up until someone tells me otherwise. That doesn’t mean landing in someone’s inbox once a week, but every 7-10 days is often enough for me to try.

TIP FOR FOLLOW-UPS: When you're finishing up a call with an investor, ask to book in a follow up in a couple of weeks. Having something in the diary creates less anxiety for you and more opportunity to speak to anyone who is really interested. 💡 Lessons learned

Quote of the week

You must remain focussed on your joruney to greatness — Les Brown

LESSON 👩🏾🏫: You are responsible for creating your own peace (even during a painful process)

Fundraising isn’t for the faint-hearted.

You’ll get tens or hundreds of no’s before you get a yes, people will move slower than you’d like them to and some conversations will be more draining than energising.

In all of that, you as a Founder have to find a way to create a sense of peace and keep it moving. I’ve learned this the hard way 😅.

I kept feeling really frustrated when people offered their support (whether it be pitch deck feedback, introductions or anything else) and then they failed to follow through.

When someone committed, I made plans with that in mind. If someone was going to offer deck feedback, I might hold off on sending the latest version for a couple of days. If they were going to make an introduction, I would hold off on reaching out myself. So, when the help didn’t come through it would leave me feeling deflated.

Disappointment like this can be a huge energy burn and it definitely doesn’t help when a process is already tough.

So now I take a different approach.

I’m always super grateful when someone offers to help or support my investor outreach efforts. I’ll make a mental note of what they’ve recommended or committed to, but I don’t pause anything that I had planned to do. Emails still go out, calls are still booked, and decks are still shared.

That way, if nothing happens, my motor is still turning and (while it’s still a bummer), it hurts far less and doesn’t cause any disruption. I’m at peace knowing that hard work is still in progress.

When push comes to shove, I’m responsible for finding my own sense of peace and creating calm in the middle of the storm. No one owes it to me, and I’m not entitled to it. And that, above all else, helps me to prioritise the decisions that will keep me emotionally grounded while I raise.

TIP FOR CREATING PEACE: know that many people will mean well and will offer to help even if they don't have the bandwidth to. Not taking things personally is key to survival, but also don't expect people to do as you would do. Everyone is different and will handle situations in their own way, give people the grace to make mistakes and don't hold any long lasting grudges. 💥 Hack of the week

Presenting your market value in a pitch deck

When you’re trying to demonstrate the value of an industry that’s super niche, any slides about the market are valuable and help to validate the probability of your product being able to reach a large enough audience.

I really struggled with this when I spoke to investors a few years ago. The hair and beauty market is huge, but so many people question whether narrowing the focus to the afro/curly hair market makes the business viable.

With more feedback, I’ve found slides like this one 👇🏾 help to demonstrate exactly what a business can offer.

Instead of using ‘market’ as a label every time, you would use TAM, SAM and SOM, which mean:

TAM: Total addressable market is useful for businesses to estimate a specific market’s potential for growth. This also helps companies figure out product market fit.

SAM: Serviceable addressable market is most useful for businesses to understand the portion of the market they can acquire to figure out their targets. Due to the limitations of your business model (e.g. geography), you won’t be able to service everyone, but you should have a rough idea of the market that’s available to you.

SOM: Even with one competitor, it would still be difficult to convince an entire market to only buy your product. That’s why it’s crucial to measure your serviceable obtainable market to estimate how many customers would realistically benefit from buying your product or service.

Sounds much more complicated than it actually is, so here’s an article that breaks TOM, SAM and SOM into more digestible chunks.

📚 Resources

Nothing to share this week! Hopefully, I’ll be back next week with more resources.

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Each week, I’ll share 1-3 tools that I’ve added (or removed) from my toolkit and, hopefully, they’ll serve you well too. Here’s a list of the best tools that I found last week…

Milkshake: Microwebsites for social media bios

What’s it for: Creating a micro website that can be used in your social media bios (e.g. links to PR, blogs, products).

How it helped: Very helpful for providing more information than basic link creators (e.g. linktree), but without overloading people.

Price: Free

Rating: 5/5*, easy to use!

Questions? 🤔

Feel free to drop any questions in the comments below! Until next week,

J x

P.S. Here are some of my other posts:

P.P.S. Enjoy this newsletter? Subscribe and please share with a friend who could benefit from reading it!