86 days to go: another commitment, accelerators and more

A recap of week twenty one as a full-time Founder.

Hey there 👋🏾,

For those of you who are short on time, here are the sections of the newsletter you can skip ahead to…

Win🏅: We have a commitment from the Board member of a global Black hair and beauty brand 🥳

Loss 🤕: Email deliverability took a hit and had an impact on cold outreach

Lesson💡: 3x things that drastically improved my pitch over time

Hack 💥: Check out the newsletter referral rewards

As always, I appreciate feedback, so feel free to leave comments or reply to this email with your thoughts.

🎯 Objective

Prep for investor conversations & celebrate the win✨

Last week came with an abundance of wins, the biggest one being a commitment from an operator within the Black hair and beauty space 🎊.

Getting commitments helps in so many ways. Beyond getting closer to closing a round, they’re also:

a HUGE morale boost for the team, especially when everyone is working hard behind the scenes to make things happen.

a sign that we’re resonating with the right people who understand what we’re trying to build.

When I look back on how I felt three or four weeks ago, it’s incredible to see just how much can change in such a short period!

As always, a big thank you to everyone who has been reading along, sharing the 240 Days newsletter and offering to help in any way that you could. I really appreciate the support and hope that these weekly updates continue to help Founders who are raising!

🔋 Progress recap & highlights

Biggest wins

WIN 1️⃣: We have a commitment from the Board member of a global Black hair and beauty brand 🥳

About six weeks ago, I started a new round of cold email outreach, targeting Senior Executives in the Black hair industry. Mainly as I know they will understand and care about the problem we’re solving, and having investors like that onboard can be game-changing.

I’m really happy to say that we’ve found another investor who is an incredible fit.

They are a board member of EDEN Bodyworks, a global Black hair and beauty brand, based in the US, that has been around for 20 years.

As a Founder, one of the most important things is finding the right investors. These relationships are a bit like a marriage, you have to find the right people who will be along for the ride in the long run (for better and for worse). And there’s no better feeling than finding someone who ticks all of those boxes.

TIPS FOR FINDING EXECS IN YOUR INDUSTRY: Use LinkedIn to find the companies and make a list of the Senior Executives on their team. Then, use a tool like Skrapp.io to find their email addresses and Hunter.io to verify that those emails exist. WIN 2️⃣: 2x promising interactions with Angels + 2x warm introductions to well-matched VC funds

Given there are thousands of people, funds, and family offices to speak to, half the battle when you’re fundraising is finding the people and institutions that are a great fit.

As I’ve gone through the funding process, both understanding what the right investor looks like and engaging with them has become slightly easier. And now, I’m finding the calls that get booked are more meaningful.

Take last week for example. I had 5x exchanges with different investors, and 4x of them were really positive. Here’s what happened:

Angel 1# replied to cold email asking for a phone call on the same day: This was quite unexpected as it was the first time an investor had given me their direct phone number. And that was a great response to get from a cold email! While the time difference made it tricky to set up a call, we ended up having an exchange over text as they wanted to understand if I needed help with pulling people into a syndicate, and what the terms would be.

Angel 2# replied to a cold email and initially wasn’t interested in investing, but was happy to offer advice: given they have a wealth of community experience and understand the beauty/fashion industry, it was 100% worth having a phone call. By the end of the call, they showed an interest in investing, asked for a longer version of our deck and will be following up with thoughts in the next few weeks.

Fund 1# gained an introduction via a LinkedIn post that my mentor tagged me in: this led to a great 1st stage phone call with a Fund that has an incredible support system for their portfolio. Fortunately, they also have a quick 4-step process that typically takes 3-4 weeks to go through.

Fund 2# I gained a warm introduction AFTER reaching out to a VP in the Black hair industry: while the VP that I contacted didn’t invest, they were connected with a Fund that supports underrepresented Founders and introduced me to one of their senior leaders. Again, this just goes to show the power of cold outreach.

The running theme with all of these potential investors is they can add value beyond money. Some have a wealth of connections, others offer amazing support systems, and many have the potential to be advisors or board members. But, the main point is, that I’m gradually getting closer and closer to discovering the right people.

Here are the 3x things I look out for when speaking to Angels or VCs:

Their background: while industry experience is a bonus, what I really look for is the domain expertise that Mane Hook-Up needs. Community, for example, is very important as we will invest time and energy into finding stylists and customers in particular areas. So if an investor has a wealth of community-building experience, that’s valuable to us.

Their connections: whether they’re able to syndicate and bring Angels/institutions or, if they can help us to recruit talented people as we grow, that all has a domino effect on how quickly we can achieve our goals.

What support (beyond money) can they offer: while money/funding is obviously important, there’s much more to building a business than that. Ideally, we want investors who are happy to offer some time, support and connections too.

Taking these three things into consideration has helped me to determine whether an investor has the potential to be a good fit, hopefully, this will help you get closer to finding the right people too!

TIP FOR ASKING INVESTORS THE RIGHT QUESTIONS: you have to ask the right questions to understand if an investor is/isn't the right fit. Here are 17 questions you can ask an Angel or VC in your next meeting.WIN 3️⃣: Made it to the 3rd stage of the application process for a start-up program + in conversations with a US accelerator ✨

Last week, I made it to the initial stage of Braze’s Tech for an Equitable Future program. Good news! I’m through to the 3rd stage which is a more detailed phone call with their team. Things seem to be moving quite quickly, so I get the impression they’ll make a final decision this month.

On another note, I’m also speaking to the leader of an accelerator in the US to get a better idea of what’s involved. While there are no guarantees, the fact that they’re interested in speaking to me is another huge win.

I know there are some incredible accelerators in the world, however, there are also a lot that don’t offer the value that Founders need. So, as with most things, I encourage Founders to do their due diligence. Have a conversation with anyone who’s leading the program, speak with a couple of Founders who were in a previous cohort, and basically ask the questions that will help you to make a well-informed decision.

That’s what I plan to do! I’ll let you all know how it goes.

WIN 4️⃣: Attended Fabrik’s community leader launch event

At the end of last year, I attended at least 1x event a week for eight weeks to network, find other founders and get investor introductions.

While I’ve definitely taken my foot off the gas in 2024, I’m still making time for at least one event a month. In February, this meant attending a specialist event for community builders, run by Fabrik.

At the time, my battery was feeling a bit low, so I contemplated giving it a miss, but I’m really glad that I decided to go. Fabrik’s event was really valuable as I was surrounded by people who have a wealth of experience in community management, building and monetisation. Allowing me to learn from those who know how to build a healthy, engaged, community.

Plus, it was a relief to go to a smaller, more intimate, gathering for a change. It left me feeling energised (not drained), which was a bonus!

TIP FOR EVENTS: Use events as an opportunity to practice your 30s and 3m pitch. You'll meet a tonne of new people and you're guaranteed to be asked "so what do you do?". The more comfortable and confident you get with pitching in a room of strangers the better. It'll serve you when speaking to potential customers, partners and investors. WIN 5️⃣: I created a Fundraising Toolkit for Founders & I’m working on a 2.7k investor outreach list

One of the many things I wish I had before fundraising, is a bunch of templates for all of the documents and emails that were needed for the journey.

As it’s taken me months of research, trial and error, feedback sessions and revisions to get to this stage, I’d like to save other founders the hassle by sharing a bunch of the things I’ve worked on.

So, I’ve created a Founder’s Fundraising toolkit that has:

3x cold outreach email templates (that have had the best response rate)

3x forwardable introduction email templates

Investor outreach email template

Master pitch deck template (with 27 slides)

Financial model template

91 questions that Angels & VCs may ask

Executive summary template

List of tools for the fundraising process (and discounts for 6x of them)

To be 100% transparent, it will cost a small fee to get access to all of these templates, but you’ll have access for life so whenever I update the templates, or add extra resources to the hub, you’ll get access to all of it too. Here’s the link with all of the details if you’re interested, feel free to reply to this email if you have any questions!

I’m also pulling together a 2.7k list of investors — it’ll include email addresses, LinkedIn profiles and Crunchbase profiles — but I’ll give you all a heads up when that’s ready to share too!

WIN 6️⃣: Automations update 🤖

Similarly to last week, I haven’t made any changes to my automations - here’s the performance update:

💃🏾 0 people added to automations

📧 999 people have opened my emails (35% of the total - up 1% WoW)

🖱️ 235 clicks on our pitch deck (23.7% of those who opened - up 2% WoW)

↩️ 60 people have replied so far (6% of opens - up 3% WoW)

I’ve noticed a drop in our email opens, clicks and replies this week. However, this is likely to be a result of the deliverability issue that’s been flagged (more on that in this week’s losses).

Other positive things that happened last week:

I was introduced to 2x potential technical advisors

An event sponsor confirmed they would be supporting our first in-person events in March

Is this helpful? Share the 240 Days newsletter with your community.

Biggest L’s 🤕

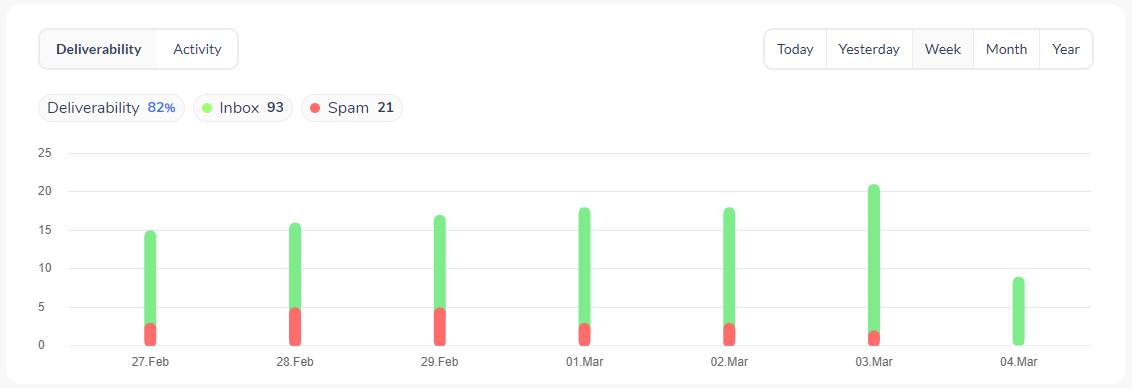

LOSS 😩: Our email deliverability took a hit and had an impact on cold outreach

Email deliverability is the percentage of sent emails that land in the inbox vs those that land in junk or spam. So, if you send 100 emails and 90 of them make it to your recipient’s inbox, and the rest goes to spam, you have a 90% deliverability rate (which is pretty good!).

With that in mind, when you’re sending a bunch of cold emails, you should monitor deliverability along the way. There are a bunch of tools you can use to do this — e.g. Lemlist, Warmy etc.

I made the mistake of not keeping an eye on deliverability and a couple of people reached out to say my emails had landed in their junk folder. After getting the heads up, I ran some tests using Mail Tester, which gave me a score of 8/10 and a couple of recommended fixes - this was helpful and allowed me to take action straight away! P.S. If you’re not a technical person, you can get a developer to implement some of these fixes.

But even though I improved the score to a 9/10, the same issue cropped up. Two people mentioned that my emails landed in their spam again. So this time, I did a more thorough deliverability test using Warmy.io. This gives a detailed overview of your deliverability per email provider (e.g. you might have a 70% deliverability rate for Gmail and 40% for Outlook) plus access to a brilliant tool that can help improve your deliverability rate over some time (from 30 to 60 days).

Warmy highlighted that our deliverability was sitting in the 70% mark which isn’t great as it should be between 85-95%. And, it flagged that there has been a dip with Apple and Gmail. That said, I started tackling the issue and, less than a week later, we’re now sitting at 82% 😮💨.

I’ll continue to use Warmy for the next 2-3 months to make sure our deliverability goes back to the right levels, but this was a serious big lesson learned.

Given cold outreach has been one of my best fundraising channels, it made me realise that a) email housekeeping needs to be top on my priority list and b) I need to be more careful when it comes to email volume as my automations have been sent to a lot of people in a short time.

A few months ago, I shared some tips about maintaining email health and how to make sure you have all of the right things in place to prevent this from happening 😅, take a look here 👇🏾

💡 Lessons learned

Quote of the week

There are no mistakes. Only opportunities.

— Tina Fey

LESSON 👩🏾🏫: 3x things drastically improved my pitch: my deck, my script and time

In the past 6 months, I’ve quickly realised that three things have significantly improved my pitch:

Improving my deck 📣: each revision to our pitch deck has drastically improved my ability to pitch. Mainly as our message has become clearer and I have made it a priority to answer the major questions that investors have upfront.

Memorising my pitch script 🤔: my first mentor advised me to create a pitch script to run alongside my deck. So I have a 5-6 page document with bullet points of the key points that I like to discuss per slide. It’s super comprehensive, and often helps me to keep a conversation on track.

Most importantly, time to practice 🕰️: every time I speak to an investor, I gain insight into the information they’re looking for and what facts/stats a) impress them and b) make my product memorable. Each conversation sharpens me slightly for the next, which allows me to get further and further into a process.

None of the points I’ve mentioned above are surprising. It makes sense that a better deck, a script and some practice runs will all help you to improve over time. But I underestimated the impact of what it meant to practice. Doing test runs with advisors and mentors is all good, but there’s nothing that beats the experience of speaking to investors and understanding what it feels like in the heat of the moment.

Pitching is a bit like exercising. The more you do it, the stronger you become and the easier it feels next time around. That said, I recommend that anyone starting their funding round consider the following:

Start by talking to investors that AREN’T on your A-list: this gives you a chance to make mistakes and develop your pitch with people that are less risky to lose. Remember, first impressions count and can rarely be undone.

Pay attention to the stats and facts they get hooked on: I remember the first time I told an investor the number of people who search for afro hair stylists a month and it genuinely blew their mind 🤯. That reaction reminded me to always mention the search stats during investor calls and, I kid you not, I get a similar reaction every time and it immediately makes the conversation more interesting.

Pay attention to the questions that come up time and time again: repeat questions tend to mean one of two things. 1) You didn’t shed light on a major area of due diligence during your pitch or 2) there is a gap in your business that needs to be addressed. Either way, take note and start tackling the issue.

If you get deck feedback, listen and apply what you can: all of the deck advice that I’ve had has been priceless and, while making changes gets exhausting, remember this can be the difference between getting a callback, or not. Be open to making changes even when it feels like you’re on version 1,500.

If I could go back in time, I would give myself grace at the beginning of the journey and not dwell on the earlier mistakes that I made during pitches. It was part of the learning process and, from it, I have become a better Founder.

TIP FOR IMPROVING YOUR PITCH: Use Loom to record your pitch and send it to other people for review. This is a great way to collect and implement feedback quickly. Try to do this in between speaking with investors.💥 240 Days to Raise Referral Rewards

Get fundraising templates for referring friends to sign up for 240 Days

I’m on a mission to help as many Founders as possible as they fundraise and I need your help to reach more people.

Now, you can refer friends, family and colleagues to sign up for my newsletter and, in exchange, I’ll share some of the templates that I’ve developed over the past six months. Here’s what you have a chance to win 👇🏾

3x referrals: get access to the list of 91x questions I’ve collected that Angels & VCs may ask you.

8x referrals: get access to a 27-slide master pitch deck template and advice on what to include in longer or shorter decks.

25x referrals: get access to the first version of my fundraising toolkit, which includes 11x templates and 6x discounts for tools. PLUS a secret bonus gift 😉

Each time you hit a milestone, you’ll automatically get an email with access to each reward.

I don’t have any new hacks for this week, but here are some that I’ve written in the past:

What to consider when paying someone to build an investor outreach list

How to find investors details on Crunchbase (without paying a penny)

📚 Resources

If you made it all the way to the end of this newsletter, you deserve a reward. So here’s a list of the best resources I came across last week to help you with your raise.

Fundraising

Pitch deck advice: Marcus Exhall explains what slide is often missing from pitch decks and how to make sure it hits home.

General advice

Community: Clare Sutcliffe, ex-VP of Community at Multiverse, shares her advice on what it takes to build a community.

Tools recommended to CMOs: Emily Kramer, founder of the MKT1 newsletter, shares the 11x tools every marketing specialist should have in their toolkit.

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Here’s a list of the best tools that I found last week.

Questions? 🤔

Feel free to drop any questions in the comments below! Until next week,

J x

P.S. Here are some of my other posts:

P.P.S. Enjoy this newsletter? Subscribe and please share with a friend who could benefit from reading it!

Go Jade! Consistently blown away by your pace of learning and generosity with sharing your journey. Good luck with accelerator convos!