169 days to go: making angel syndicate applications

A recap of week ten as a full-time founder

Hey there 👋🏾,

For those of you who are short on time, here are the sections of the newsletter you may want to skip ahead to…

Win🏅: Researched global Angel Syndicates and made 10x applications

Loss 🤕: Missed out on a pitch night

Lessons 💡: How to combat the lows of the no’s

Hack💥: Using Reddit to start conversations with customers

As always, I appreciate feedback, so feel free to leave comments or reply to this email with your thoughts.

🎯 Objective

Double down on Angel Syndicate applications

As Christmas is just a few weeks away, I’ve been working on any heavy lifting that will make sure January is super productive. This includes:

I’m holding off on emailing new investors and focussing on completing Angel Syndicate applications

Applying some of my learnings from events to real-life situations

Last week was also packed full of small wins that have built up from incremental gains I’ve made since October, so it’s always a win to see the hard work and sweat starting to pay off.

🔋 Progress recap & highlights

Biggest wins

WIN 1️⃣: Researched global Angel Syndicates and made 10x applications 🌎

A few weeks ago, sent me a map of 30,000 Angel Syndicates around the world (huge thank you to the Female Founder Rise community for putting this together). This has been a game-changer for my outreach strategy as it has:

Helped me to identify other investor regions I should focus on beyond the UK, Europe and the US

Given me enough information (e.g. location, website, focus) to do some desk research and create a shortlist of Syndicates

Allowed me to prioritise completing 10x Syndicate applications last week alone

I’ve also decided to submit all of my applications, before Christmas.

Here’s why.

Of the Syndicates I’ve applied to so far, the majority have replied to my application in 3-4 weeks.

With that in mind, any applications made in the New Year (when there will also be an abundance of Founders kicking off their fundraising process), will probably get a response end of Jan, or early Feb. And, that could be even more delayed with a higher volume of submissions.

With fewer applications at this time of year, there’s less competition and investors have more time to review what I’ve shared in detail. So, making my submissions in the December slow season increases my chances of being seen, heard and considered.

For example, of the applications I made last week:

1x Syndicate replied to set up a call (on the same day)

2x let me know we’re not quite the right fit (either because of the investment thesis or because they invest in Founders who live in a very particular region).

So, I’m getting responses at 4x the speed.

Strategically, knowing that it makes sense to go against the grain and get my applications in now, helps me to prioritise my workload over the coming weeks and gives me a lot of confidence that I’ve used my end-of-year time well.

TIP FOR SELECTING ANGEL SYNDICATES: Like VCs and indivudual Angel's, Syndicate's will also have an investment thesis. It pays to remember that many of these are localised (e.g. a Syndicate that supports founders in New York) and that may automatically disqualify you from their application process. Make sure you go through their website with a fine tooth comb to find their investor criteria. The application forms can be lengthy and it's not a good use of your time to work on one that you're not right for. WIN 2️⃣: Made it to the first interview stage for Antler 🫎

Antler is one of the biggest communities and investors for early-stage founders. They have locations across six continents and help people take companies from conception to the real deal.

I applied a few weeks ago and have made it to the first round of interviews 🥳. Here’s a quick overview of what the application process looks like.

Fortunately, Antlet does share a lot of helpful resources ahead of their interview, so I feel well prepared.

Given how competitive these spaces are, I’m also happy to have made it to the first interview. I’m speaking to the team on the 22nd of December so I’ll shed more light on the process in my first newsletter of 2024!

TIP FOR ANTLER APPLICATIONS: If you have a pitch deck, have made funding applications or Syndicate applications, you should be able to lift some information from these when you're completing Antler's form. It should take you 10-15 mintes to complete, but it is worth having a templated response to some of these questions. WIN 3️⃣: Attended Odin x Dream Factory’s event ‘Turning Your Community into Your Cap Table’ 📆

Another day, another event! I grabbed a spot at Odin x Dream Factory’s event on Thursday — it was all about turning the people in your community into investors and believers. This was also one of the best events I’ve been to in the past few months, as there were a tonne of great takeaways. Here’s what I learned:

Building relationships with Angels 😇

Remember, Angels are not institutions so the relationship is very personal: Don’t try to force a transactional conversation, take your time and get to know them well. Be patient when you’re relationship-building.

Speak to Founders who have closed a round: they can introduce you to investors. A lot of deal flow for Angels and other investors comes from their network as they’re more likely to trust warm introductions.

Make it clear what you have to offer: Angels will remember and appreciate Founders who can help them too.

Closing a round 💰

Small ticket Angels can lead to big gains: Remember that Angels have a network that they can introduce you to. A smaller $1k ticket can lead to significantly more through introductions (whether that’s more investors or potential customers).

Don’t be afraid to say no to investors who aren’t a good fit: You want to find the people who will energise you and support you along the way.

Profile building 🧱

Be active and visible in the right places: (e.g. LinkedIn and your investor update emails) — you never know who’s watching and may be interested in a few months once they’ve seen your name crop up often enough.

Team building and leadership 🙋🏾♀️

Make sure you find and hire A* team players: this is especially important for solo founders who need to rely on their team to keep the ship afloat when they’re out raising. Don’t compromise, as you’ll inevitably have to let people go and it will eat into your runway.

Hire people with the right experience (not the big, shiny, well-known company): Just because someone has ‘ex-Google’ or ‘ex-Apple’ on their CV, doesn't mean they are the right fit. Remember companies of this size are optimising 1-3% of performance not growing 20-30%. You need people who are builders and doers, so look for people who can create something from very little.

For me, the investor update message was the most important takeaway. I have been very guilty of not prioritising these emails and I’ll be rectifying that in January by getting back into the swing of things.

A huge thank you to Odin and the Dream Factory team for putting this event together! It was a night of great company and food.

TIP FOR EVENTS: You will probably get 5-10 nuggets of gold from each event that you go to, but you won't be able to apply everything at once. Prioritise the 1-2 things that will help you most given what your business needs. This will reduce the system overload and help you apply any practical advice quickly post-event. WIN 4️⃣: Had my first team social media filming session 🎥

While I’ve been very active on my personal social media accounts for the past two months, I can’t say the same for Mane Hook-Up’s pages [sweat emoji]

Me and the team have been brainstorming ideas of content to create and how we can best resonate with our audience.

On Wednesday we finally came together (to the co-working space where I’ve set up camp) for a filing session.

We’ve decided to focus on social media as the data collected over the past few years tells us there’s a large volume of afro hair stylists and their customers using Facebook, Instagram and TikTok.

Focusing on all three channels would be too time-consuming and probably limit our ability to build an audience, so we’ve narrowed it down to two (TikTok and Instagram) where we’ll largely focus on creating videos. Mainly as there are fewer restrictions on TikTok right now and we can reach a wider demographic.

Social media also has a tangible outcome for both the business and the raise. Social audiences that are large enough to contribute to social proof of concept, and the platforms we’re focussing on allow us to do in-app lead generation through our profile (helping us with waitlist subscribers). Given how much myself and the team have to do, we

Here’s a quick behind the scene’s photo of us at work 👇🏾

Day one and session one wrapped up, and we’re now focussing on sharing two videos a week and seeing if that has an impact on our engagement. I’ll let you know how it goes!

TIP FOR SOCIAL MEDIA OBJECTIVES: Creating content is already time-consuming, so make sure you're doing it for the right reasons by setting concrete ojectives for what social meida is supposed to achieve. Whether it's social proof, customers or subscribers, your team should be clear on the outcome you're looking for. WIN 5️⃣: We have 60 people on our investors update email list 👩🏾💻

One of the most valuable lessons I took from Odin’s event is the value of investor updates.

The panellists made it really clear that these emails help investors re-engage with what your business is doing and even get referrals for a raise.

I’ve been slacking with mine, and that will all change in the first week of January when I send my first update for 2024.

In the meantime, I pulled together a list of all the investors I’ve spoken to in Dex (another new tool), which helps me manage all of my relationships with anyone that I meet.

Here are some great investor update templates/articles you can make good use of:

TIP FOR SENDING UPDATES: Ideally, use a tool that helps you to track email opens and clicks. That way, you can see how many investors are engaging with your emails, who is the mosyt engaged and how many times it has been forwarded. All helpful data points for you to consider when starting conversations. WIN 6️⃣: Email automations update: increase in opens and replies 📧

Here’s a quick update on how the emails are performing:

👯🏽 Added 315 people to automations (with a 2x week break from the 18th December)

📧 1,053 people have opened my emails (up 3% WoW)

↩️ 92 people have replied so far (down 18% WoW)

🥈 80 people replied after the 2nd email in the series (u 21% WoW)

Surprisingly, opens and replies have continued to increase week on week, despite going into December. My last set of emails will go out on the 20th of December and then I’ll start the auotmations up again in the new year.

People are replying faster now than they have done in previous months, so I’m estimating 100-110 replies by next week.

Other things I managed to get done last week:

Reached the review stage for 2x Angel Syndicates

Launched my final automations for investor outreach for 2023

Made tweaks to our pitch deck to better demonstrate the market value

Set 2024 objectives and Q1 OKRs

Is this helpful? Share the 240 Days newsletter with your community.

Biggest L’s 🤕

LOSS 😩: Missed out on a pitch night because I didn’t submit my application in time

Dropping the ball is never fun, but it happens.

Someone in one of the founder WhatsApp communities I’m in shared a link to a pitching competition and the submission deadline came and went before I realised 😭

While I am disappointed on missing this pitch night, it has made me consider how to keep track of anything that comes with a deadline. I’ve started using a tool called Reclaim.ai that helps me to build my to-do list into the week and get things done long before the deadline. Highly recommend for sonyone who’s struggling to keep on top of things.

LOSS 😩: More ‘no’s coming in from funds and syndicates

I’m not sure whether this counts as a loss, or it’s just part of the journey now, but last week we had three replies:

2x angel syndicates and 1x fund said we weren’t the right fit

1x cancelled investor call (now rescheduled for next week)

On the upside, one syndicate has offered to share feedback this week and that is always super valuable as it allows us to adapt to the market. They’ve also asked to stay in touch so I will be adding them to our investor updates email list.

TIP FOR RESPONDING TO NOS: There's still so much value you can get from a conversation that ended with no. Follow-up, ask for any feedback and ask if they're happy to be kept up-to-date with your progress. Remember, investors often get deal flow from other investors, so it pays to have people on your update list, even if they have said no. 💡 Lessons learned

Quote of the week

Don’t be afraid. Be focussed. Be determined. Be hopeful. Be empowered.

— Michelle Obama

LESSON 👩🏾🏫: Questions from investors are always a win

As the weeks go on, more people replies come through. Some with answers (e.g. yes, let’s book a call or no thanks), but the best emails are the ones with questions.

And last week, I got a great question about my market value.

How did you calculate this market value?

Global GDP is about $100T. So curly hairdressing would be about 1/300th of the entire global economy. I find that surprising.

This is really interesting for a few reasons:

I hadn’t thought about the market value in relation to the global GDP

This person is surprised, but asked me a question to get a better understanding

I know how much money is spent per hair appointment and how many people typically make bookings, so even with the GDP taken into consideration, I’m not suprised

I won’t share my reply in the newsletter (sorry, some things will have to remain a mystery), but in short I shared data on average spent on afro/curly hair appointments a year and some population data to better explain why the market is worth so much.

Now, had this email been sent to me 4-5 weeks ago, I probably would have panicked, assumed they thought I didn’t know what I was talking about and wrack my brains for an hour pulling a reply together.

Last week there was no panicking, just 10-15 minutes of crafting a response that made sense and will hopefully lead to a follow-up conversation.

As a Founder it’s very easy to forget just how much we know about our industries, and it isn’t a given that people will know those figures, or have context especially when it comes to niche industries.

Just remember, questions are good. It’s often indicates someone is curious and is your chance to show just how much you know.

TIP FOR REPLYING TO QUESTIONS: once you've share the details and answered their questions, add a call-to-action to the email. For example, can we bookn a call? can I send you my deck etc. Questions are great, but what you ultimately want is a call. 💥 Hack of the week

Platforms you can use to find Angel Syndicates

One thing is for certain, there’s an app for pretty much everything. Including finding and completing applications for Angel Syndicates.

And, there are two you should make the most of:

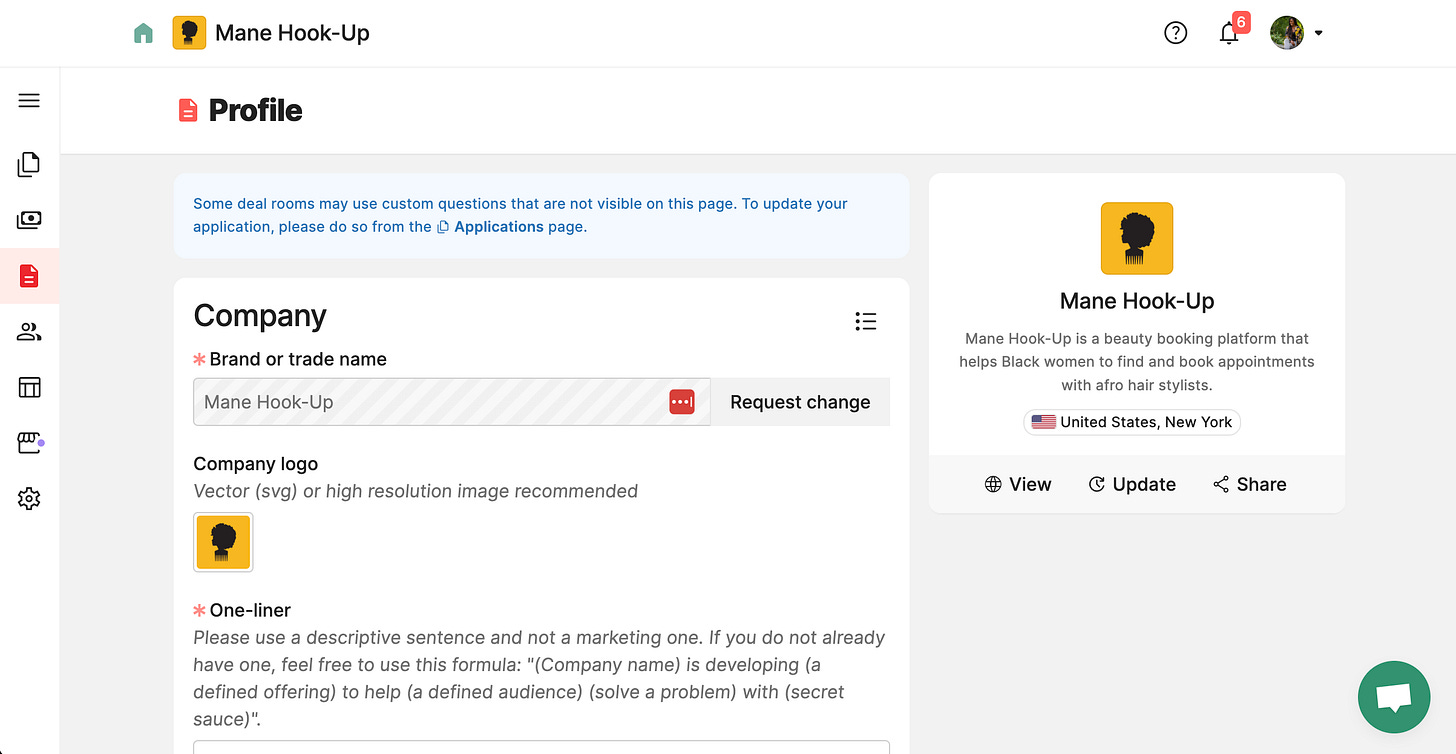

Dealum: a platform that helps investor groups to get started, grow or be managed.

Pros: Once you’ve completed one or two applications, it also recommends other Syndicate groups and investors that you can apply to. It’s also really well-designed and easy to use.

Cons: You can’t save/search different investor groups based on your preferences. So you either need a direct link to the Syndicate or for the group to appear in the recommended groups section.

Gust: a platform that helps founders start, accelerate and raise.

Pros: With it, you get a start-up profile and also find other funds and syndicates that are using the platform.

Cons: Quite fiddly to use and a very limited character count per response.

The beauty of both platforms is that all of your answers are saved for future applications, so it doesn’t feel like you have to re-write every answer repeatedly. If you combine this with the Female Founders Rise syndicates map, you’ll be in for the win.

📚 Resources

If you made it all the way to the end of this newsletter, you deserve a reward. So here’s a list of the best resources I came across last week to help you with your raise.

Funding for women and minority founders

Sephora: Black beauty founders: apply for $100K grants

Ganas Ventures: Community-driven founders: apply for $100K

HerSuiteSpot: WOC founders: apply for $1K grants

Wish: Black founders: apply for $500-$2K

Workers Lab: BIPOC women: apply for $200K

Amber: Women founders: apply for <$10K grants

Z Fellow: Technical tinkerers: apply for a $10K grant

TechRise: Chicago founders: apply to win $50K

SoGal Foundation: Black women founders: apply for $5-$10K in grants

1863 Ventures: Black founders: apply to get a 3Rs $5K grants

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Each week, I’ll share 1-3 tools that I’ve added (or removed) from my toolkit and, hopefully, they’ll serve you well too. Here’s a list of the best tools that I found last week…

Luma: Events platform and online profile

What’s it for: A way to create online profiles and find events.

How it helped: Luma has helped me to find and sign up for some of the best events I’ve attended all year (both online and in-person). There are times when you have to be added to a waitlist but it’s still worthwhile.

Price: Free

Rating: 4/5*

Questions? 🤔

Feel free to drop any questions in the comments below! Until next week,

J x

P.S. Here are some of my other posts:

P.P.S. Enjoy this newsletter? Subscribe and please share with a friend who could benefit from reading it!