232 days to go: Building meaningful connections in the investor community

A recap of my first week as a full-time Founder

🎯 Objective

Create a routine & start building meaningful connections

Week one under my belt and there’s so much to share! I had two objectives to ease my way into working on Mane Hook-Up:

Create a work routine that I can maintain (measured by how tired/energetic I felt)

Start building meaningful connections with other people in the Founder/investor community (measured by getting 6x calls booked in before the week was up)

It was time to put my training wheels on and start adjusting to the world where I have to manage my time carefully. The aim was to be productive while giving myself the space to make some mistakes and understand what kind of routine and environment I needed to create to do my best work.

The good news is… I learned a lot

The bad news… sometimes I learned the hard way 🥹

🔋 Progress recap & highlights

Biggest wins

WIN 1️⃣: LinkedIn & founder communities started meaningful conversations ✅

They say it takes a village to build a company, so I started my week by making a very public announcement that I would be working on Mane Hook-Up full-time. The main purpose of this post was to thank everyone who’s helped with the transition but also to drum up some excitement about the funding round. Here’s the post for anyone that missed it 👇🏾

This one announcement helped me to:

Book a call with 1x potential investor

Receive 5x offers for help and support (from warm intros to tech and email support)

Get 1x free ticket to an event in London

Get 2x offers for discounted tickets to other events in Europe

Apply for a Government scheme trip to New York that supports businesswomen with international expansion

It was incredible what a couple of posts could do, especially given how tough the fundraising climate is at the moment. But feeling that help and support from my immediate community was definitely a win.

On another note, I also shared the 240 Days announcement post on LinkedIn and 5x Founder Slack communities that I’m part of and that increased my subscriber count by 25% in a couple of days.

TIPS FOR ANYONE THAT'S NERVOUS ABOUT POSTING: Like all social networks, LinkedIn has become a bit of a mine field. Between the major career/life updates, influencers and companies building a brand for recruitment, it can feel a bit overwhelming to post anything. I've wanted share more updates and content for years, but have always felt nervous and worried that no one will care about what I have to say. But last weeks posts proved me wrong pretty quickly. My advice to anyone who has something to say (whether it's an opinion or ask for help and support) is just start posting and figure the rest out as you go along. This is a perfect case of 'done is better than perfect', you will gain so much more from just getting the word out there than worrying about what other people may or may not think. WIN 2️⃣: Received amazing advice to help me tackle investor outreach ✅

As LinkedIn became my new favourite social network, it only seemed right that I started commenting as well. During one of my infinite scrolls through LinkedIn content, I was fortunate enough to stumble across this incredible post by Alfie Marsh (Founder of toolflow.ai) where he summarised his experience of raising $500k in 12 weeks after speaking to 102 investors.

As well as reading his post, I decided to ask Alfie for some advice in the comments. Now, he has 31,000 followers on LinkedIn so it was a bit of a long-shot, but fortunately, he replied with some great advice about how to get warm intros to Angels.

Interestingly enough, I was prepared to start cold outreach before I had this quick interaction with Alfie, but given how successful he was, I’ve now changed my approach and think this week will be more fruitful.

TIP FOR COMMENTING ON LINKEDIN: My interaction with Alfie was one of many from last week and I tried to create a balance between asking for help, offering help and offering my opinion. As much as you want to get tips and advice from others, also make sure you're adding value so that people naturally gravitate towards you. The more people you can speak to during a funding round, the better. Remember that every interaction counts. WIN 3️⃣: had 2x calls with potential investors who understood the problem and market & 5 out of 6 target calls booked ✅

A call with anyone outside my immediate network is a bonus and I was very fortunate to have two of those last week. One investor came through my major LinkedIn life update (win) and the other came through the Mane Hook-Up Invest in us website after a friend kindly shared the link in one of their Slack community (winning again 😎).

Both calls were an opportunity to run through my deck and see how prepared I was for some of the hard questions that come with these conversations.

Here’s what we managed to cover in 30 mins:

Intros

The story behind Mane Hook-Up

Market, problem and solution

Details of the raise

Key questions asked:

What’s the market size?

Are you making revenue yet? If not, what’s the traction?

How do you plan to acquire more stylists?

30 minutes doesn’t sound very long, but it’s more than enough time for you to run through a mini-deck (10 mins) and have a decent Q&A afterward. I tried my best to get ahead of the typical questions that are asked (market size, traction etc), and found that more detailed questions cropped up afterwards. On reflection, I think…

What went well:

I felt well-equipped to answer questions about the market

The value of the platform was questioned but understood

What I need to improve

Remember that all investors are different — some will want to run over the deck, and others will want to shoot questions at you. I was more prepped for deck calls and had to adapt quickly to those without.

There were moments when my narrative/story could have been more concise.

Regardless of the outcome, both of these calls have helped me to understand what I can do to craft a stronger pitch in the future. It’s always important to take some time to reflect after the call or ask investors for feedback.

ADVICE ON PITCHING: Remember that from beginning to end, you're creating a narrative that investors are following. Mane Hook-Up is a platform that predominantly solves a problem for Black women, which means precision is key to helping people understand the value of what we're building. The clearer the message, the easier (and faster) potential investors will understand. Make sure you clearly demonstrate the problem is big enough for people to pay for the solution. There are often many problems to be solved, but you're more likely to get investors (or anyone else you're pitching to) to understand one very concrete problem that leads to a tangible solution. WIN 4️⃣: Got great support with the SEIS application ✅ (one for UK founders)

For anyone who doesn’t know, SEIS and EIS are government initiatives that encourage private investors to take a risk on smaller businesses that are being built from the ground up. There are plenty of incentives within the scheme, for example, investors can receive up to a 50% tax break on up to £200,000 that’s invested via SEIS every year (get a more detailed overview here).

The gist of it is, that being SEIS or EIS approved is a huge incentive for UK-based Angel investors, and that was also confirmed by the fact that almost every UK Angel or Angel syndicate that I’ve spoken to has asked if I’ve applied for SEIS.

Now, there are organisations that can complete the application form for you (for a fee that’s usually between £400-600), but I decided to do this myself after a Founder gave me the heads up that it’s simple enough to do.

So, I dedicated a day to working on my application but, halfway through, I got well and truly stuck 😅

Word to the wise, the quicker you raise your hand, the quicker someone can help you to see the wood through the trees. I made the mistake of spending half a day trying to figure this out by myself before finally throwing the towel in and asking a fellow Founder for more help.

This help came in the shape of 3x phone calls, 3+ hours of both of us scratching our heads only to figure out that I had filled in the wrong form 😭 and to save Founders everywhere in the world of pain that I experienced, here are the links you need:

Application to become SEIS/EIS approved (the one I should have started with)

Application to use SEIS/EIS AFTER investment has been raised

Thank me later!

P.S. A huuugggee thank you to Kufa Matiya for all of your help last week, I would have been lost without our many Zoom calls.

Other things I ticked off the list:

Had pitch practice with 1x seasoned investor

Pitch deck, forecasts/financials and prospectus are all done

Made 4x applications for major funders or Angel syndicates

Updated investors that had shown an interest in Mane Hook-Up in the past — 1x replied & 1x connected on LinkedIn (used this message template — copy the Google doc)

Business admin is largely taken care of (e.g. accounting, contracts, the boring stuff no one wants to talk about but everyone has to do)

Launched the 240 Days to Raise newsletter 🥳

TIP FOR COMPLETING THE SEIS/EIS FORM: The application requires some documentation (such as a business plan, shareholder agreement and Prospectus). Fortunately, I had most of this ready to go so it was just a case of filling in the blanks. But, if you're starting from scratch, put a few days aside to get all of your documentation right. I also recommend finding someone that can create a shareholder agreement for you (e.g. via Upwork or Fiverr), instead of grabbing generic templates from online. Biggest L’s 🤕

LOSS 1 😩: Wasted a lot of time with the wrong SEIS application form

This was entirely my doing… In my rush to get the application in, I didn’t take the time to read through all of the information on the UK Gov website. Meaning that, a task that should have taken a day or so, took nearly two weeks, and that’s time I don’t have to waste.

The lesson for me is to take my time to get into the details. There’s a time for speed and a time for precision, it’s my job to know when to opt for one of the other.

LOSS 2 😩: Only a couple of responses to Investor outreach LinkedIn messages

Posting and commenting regularly on LinkedIn definitely improved my engagement on the platform (which is great) but I want to combine that with improving my reach. To do that, I started to connect with a few people well outside my network — typically 2nd and 3rd-level connections.

But, I made three mistakes:

Not sending an introduction message with a LinkedIn connection request: doing this reduces your chances of someone accepting a LinkedIn connection request. It can come across as lazy to certain people (ironically, myself included), and in a world where I’m sure investors have messages up to their eyeballs, doesn’t help anyone to stand out for the right reasons.

Not sending a follow-up intro message to the people I connected with most recently: And for those who did accept my connection request, I didn’t follow up, say thank you or ask for a call. This is a lost opportunity to connect with someone more organically and see if they’re happy and willing to help.

On the flip side, if I did send a message, jumped in with an ask way too quickly: Sometimes, it’s better to warm people into who you are, and what you do rather than jumping straight into ‘I’m raising a pre-seed round, it would be great to chat!’. Personally, I prefer people to be upfront with their asks, but that’s not how everyone operates and it’s something for me to bear in mind.

This meant that, while I gained a few new connections, I reduced my chance of starting a meaningful conversation with some of them. Something to learn for next time — patience is key.

💡 Lessons learned

Quote of the week

If you want to go fast, go alone. If you want to go far, go together — African Proverb

LESSON 1 👩🏾🏫: Ask for help at every turn — solo founders need a village too

Even though the world feels smaller and we’re more connected than ever before, there are still a lot of people who hesitate to ask for help (myself included). Without the many people who came to my rescue this week, there are plenty of things I wouldn’t have been able to do. I’m super grateful for every inch of support as it makes the journey as a solo founder much easier as well.

The moral of the story is, don’t wait until you’re on your last legs to ask for help — getting it sooner rather than later saves a lot of time, energy and headspace.

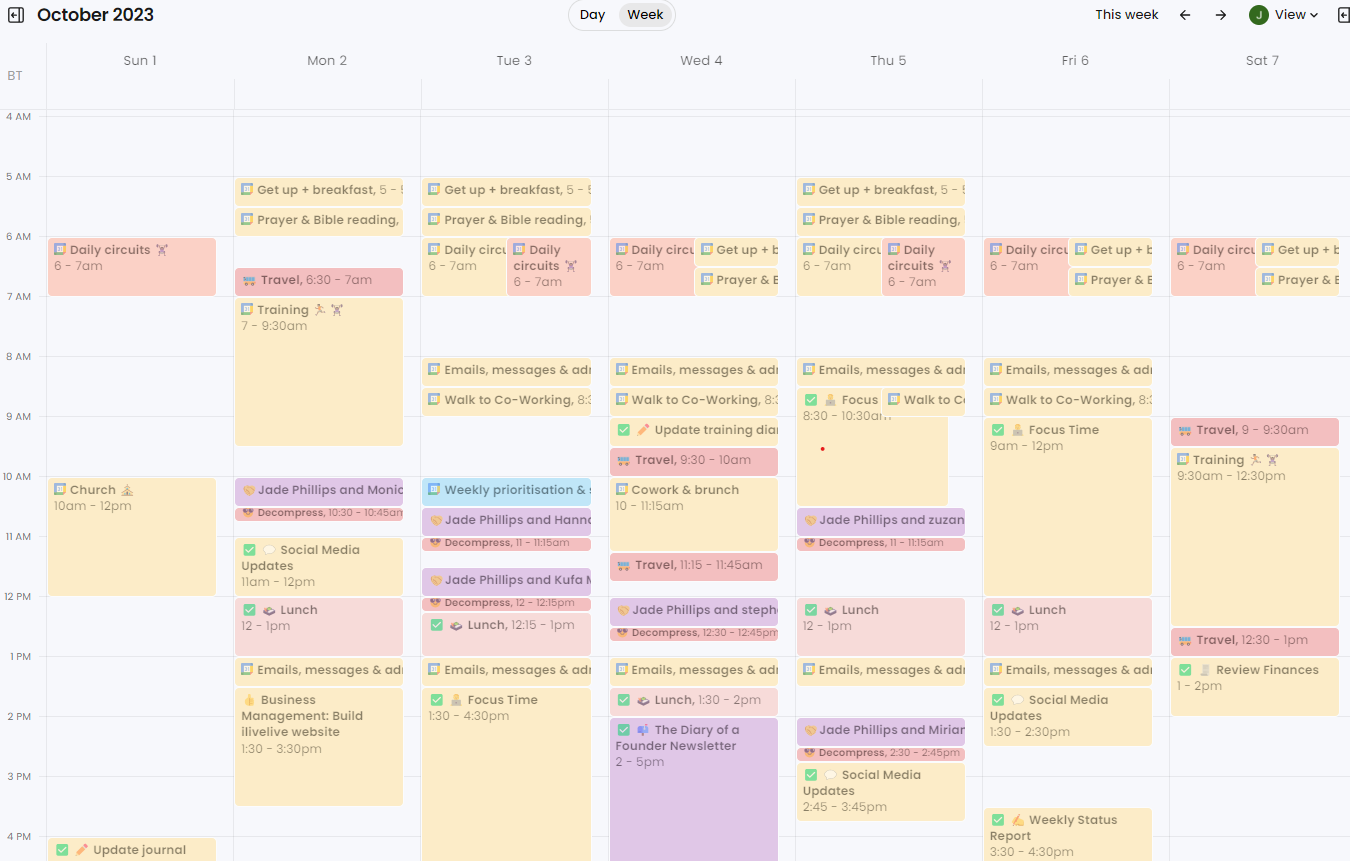

LESSON 2 👩🏾🏫: Timing myself as I work makes me more aware of time well spent and time wasted

If you read my bonus post, you’ll know that I recently bought a productivity planner. The planner also recommends working on tasks in 30-minute busts before taking a 5-minute break and going at it again — very similar to the Pomodoro technique. Interestingly, the more I timed myself, the more aware I became of how long I spent on each task and (generally speaking) the faster I worked. Great technique for creating a sense of urgency when needed.

LESSON 3 👩🏾🏫: Waking up at 5 am every day is a no-no (even if I love having extra hours to plough through work)

I gave myself the task of getting up at 5 am… six days a week. I couldn’t do it for more than two days because I kept staying up late or coming home late from events. Note to self: 6 hours of sleep is a must and a minimum. Without it, I will struggle to get that extra time in the morning where I’m most productive.

🧰 Founder’s toolbox

Anyone who knows me knows that I love finding tools, apps and systems to add to my arsenal. Each week, I’ll share 1-3 tools that I’ve added (or removed) from my toolkit and hopefully, they’ll serve you well too. Here’s a list of the best tools that I found last week…

Slidebean for pitch decks

What’s it for: Online presentation software that allows you to create several variations of your deck (both online versions and PDFs).

How it helped: Amazing presentation software that has 101 templates that Founders can make good use of. They also have an agency arm that supports founders with deck creation. You can download PDF, PowerPoint or HTML versions of your deck.

Price: $199/yr to get access to most of their features

Rating: 5/5*

Reclaim.ai smart scheduling

What it’s for: Building your to-do list into your calendar to create isolated time for important tasks and help create helpful recurring habits.

How it helped: Reclaim helped me to prioritise high-level tasks and evenly distribute my tasks to make sure I hit deadlines. My favourite feature is the calendar links that will automatically create new Zoom or Google Hangout URLs and be dropped into your calendar at a moment’s notice.

Price: Starts from $10/m

Rating: 4/5* — the only thing I would love Reclaim to do is put tasks in order of importance.

Fireflies.ai call recaps and action lists

What it’s for: Automated transcripts and meeting notes from online calls (e.g. Zoom and Google Hangout).

How it helped: For the first time in a long time, I was able to give the person/people I was on call with my undivided attention, as Fireflies did all of the note-taking and listed all of the action items.

Price: Starting from $19/m

Rating: 3.5/5* — The free version is very limited and you have to contact customer CS to drop down from a paid to a free tier.